The WU Global Transfer Pricing Conference took place in Vienna from February 19 to 21, 2025, gathering experts from around the world to discuss the latest challenges and trends related to transfer pricing. The conference addressed key issues surrounding global transfer pricing regulations, as well as the role of new technologies in transfer pricing management. Special attention was given to the , which was designed to simplify the application of the arm’s length principle, though its future remains uncertain.

Global Trends in Transfer Pricing

The conference highlighted the rapidly evolving transfer pricing regulations at the international level. This subject continues to gain importance in the context of initiatives by the OECD, the UN, and the European Union, which face the challenge of adapting to the changing global tax landscape.

- OECD – Amount A and B: Experts agreed that the implementation of Amount A and B is encountering various challenges. While the OECD introduced these mechanisms as part of a package, many jurisdictions are opting for the optional adoption of Amount A, which adds complexity to the global harmonization of rules. On the other hand, Amount B, proposed as a tool to simplify the application of the arm’s length principle, has faced doubts, and what is surprising not only in European countries. In general, many countries are concerned about its effectiveness and feasibility in diverse markets.

- OECD – Pillar II (Globe): The implementation of the Pillar II is gaining momentum, with 70 countries having introduced or planning to introduce these regulations. It is expected that 90% of multinational enterprises (MNEs) will need to comply with the new OECD rules, with Europe playing a leading role in the implementation.

- European Union: The EU is focusing on simplifying tax regulations. The proposal to create a separate directive on transfer pricing has been abandoned due to concerns about the jurisdiction of the EU Court of Justice in this area. Nevertheless, the EU continues to work intensively on simplifying and harmonizing tax regulations across the Union.

- UN Tax Committee: In 2025, the UN Tax Committee, following changes in its composition, has announced new priorities, including further work on transfer pricing, which will play a prominent role in global tax policy.

Amount B – A Simplification Mechanism or a Barrier?

One of the key topics discussed at the conference was the Amount B mechanism, aimed at simplifying the application of the arm’s length principle for transactions such as low-risk distribution. While the OECD introduced Amount B as a potential simplification tool, many countries are not yet ready for its implementation.

- Implementation of Amount B: Although some countries have started implementing Amount B, the list of countries that will fully adopt this mechanism has not yet been published. Preliminary information suggests that some countries, such as Nigeria, will not adopt this solution at all.

- Challenges in Simplification: Experts pointed out that Amount B, despite its potential for simplification, requires balancing administrative ease with precision in compliance with the arm’s length principle. Preliminary profitability analyses conducted in certain European countries suggest that companies may not meet the requirements of Amount B, which could limit the effectiveness of this mechanism.

- Reactions from Countries: Initial support for Amount B is beginning to wane in some countries, as some jurisdictions are reconsidering their stance. One of the concerns raised is that the profitability thresholds outlined in the Amount B framework may be set too high, making compliance challenging for many businesses and limiting the mechanism’s practical applicability.

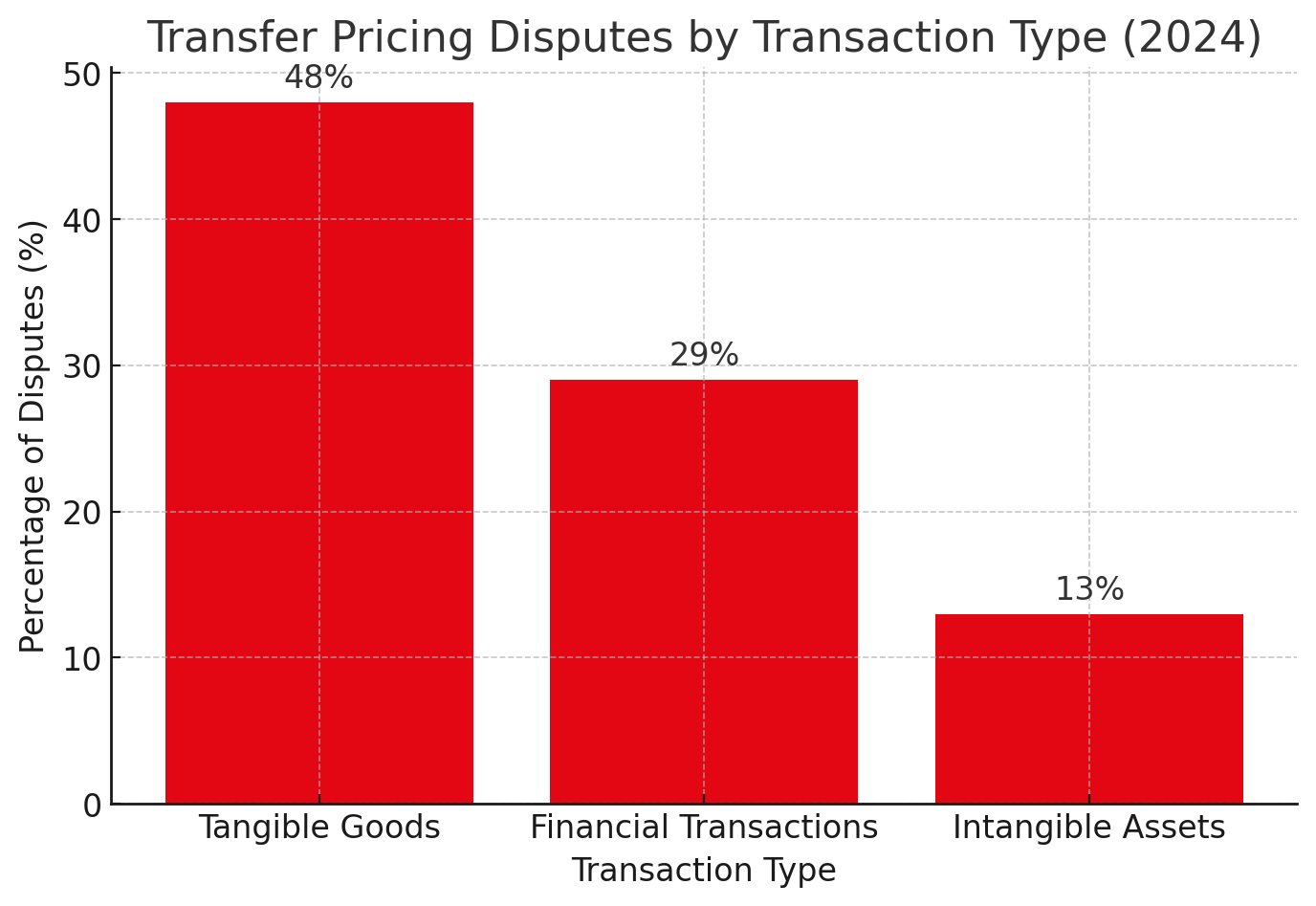

Transfer Pricing DisputesAn increasing number of transfer pricing disputes emerged as one of the key points of discussion at the conference, highlighting the growing complexity of these issues. In 2024, the majority of disputes involved tangible goods transactions (48%), followed by financial transactions (29%) and intangible assets (13%).

Source: WU Global Transfer Pricing Conference 2025.

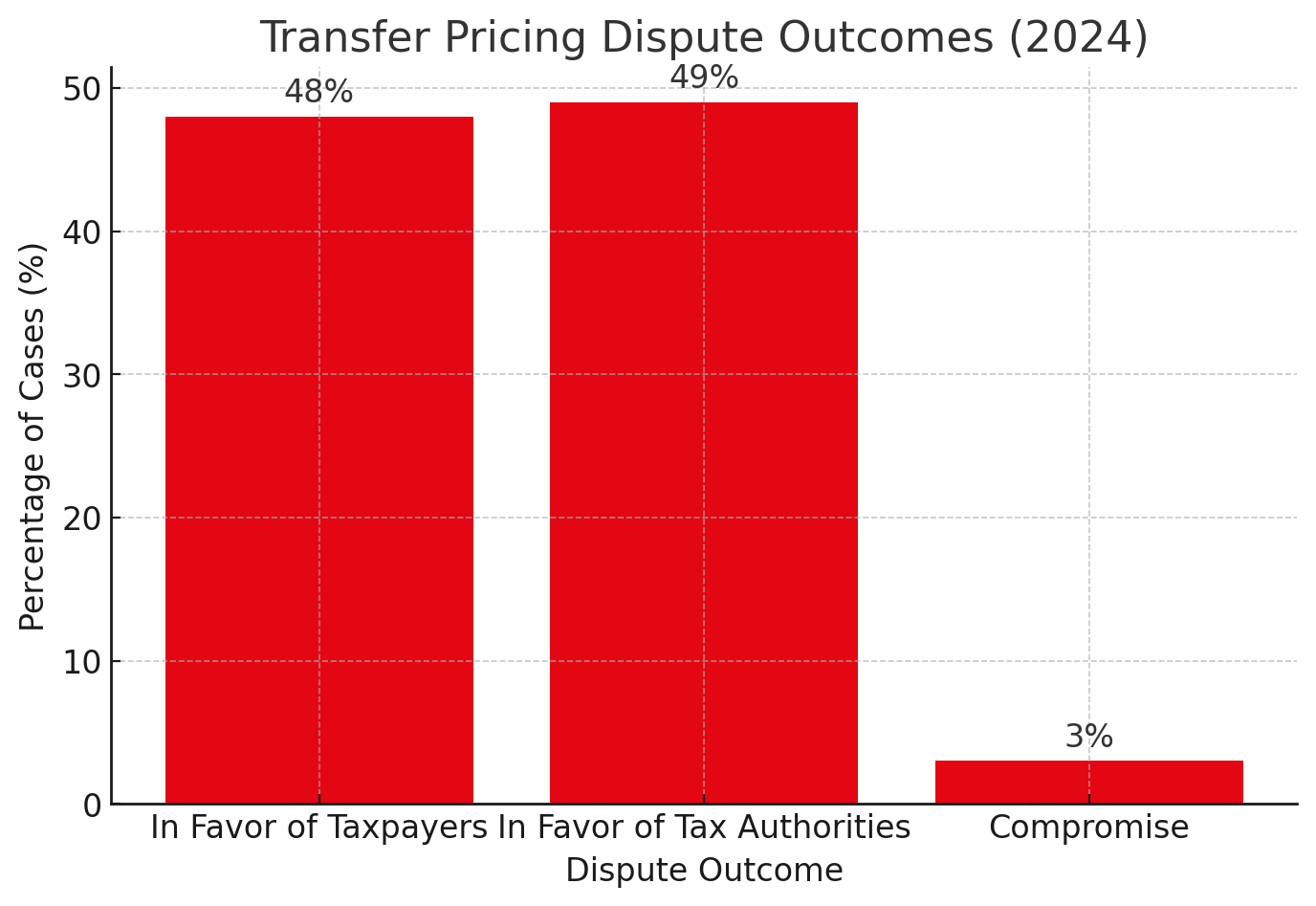

The outcomes were nearly evenly split, with 48% of rulings in favor of taxpayers, 49% supporting tax authorities, and 3% resulting in a compromise. The rising volume of cases, particularly those reaching higher courts, has raised concerns among tax authorities, as there are concerns about the lack of expertise in transfer pricing within the judiciary, which could complicate the resolution of such cases.

Source: WU Global Transfer Pricing Conference 2025.

The outcomes were nearly evenly split, with 48% of rulings in favor of taxpayers, 49% supporting tax authorities, and 3% resulting in a compromise. The rising volume of cases, particularly those reaching higher courts, has raised concerns among tax authorities, as there are concerns about the lack of expertise in transfer pricing within the judiciary, which could complicate the resolution of such cases.

Source: WU Global Transfer Pricing Conference 2025.

Cooperative Compliance in Transfer Pricing

In response to the growing number of transfer pricing audits, greater attention is being paid to mechanisms aimed at improving cooperation between taxpayers and tax authorities to enhance tax certainty and streamline the auditing process.

- ETACA and ICAP: Tools such as ETACA (within the EU) and ICAP (for routine and non-routine transactions, such as business restructurings or IP-related matters) were presented as alternatives to lengthy APA proceedings, offering faster risk assessment procedures. These mechanisms are becoming increasingly popular for managing transfer pricing risk.

- Issues with Tax Filings: The increasing number of different transfer pricing filings in EU countries has led to discrepancies in reporting requirements. Many experts recognize the need for greater standardization and harmonization of data reporting, which could help streamline compliance within the European Union.

The Role of New Technologies in Transfer Pricing

The conference also discussed the growing importance of technology and AI in the development and management of transfer pricing solutions. These modern tools are transforming how transfer pricing products are prepared, improving efficiency and accuracy. In particular, blockchain technology and big data are playing a significant role in enhancing transparency, ensuring more reliable transaction records, and refining risk management practices. Experts emphasized that these technologies are crucial for adapting to the ever-changing regulatory environment.

Conclusion

The WU Global Transfer Pricing Conference 2025 reaffirmed that transfer pricing is undergoing significant global changes. While the Amount B mechanism has the potential to simplify existing rules, its broad implementation remains uncertain. The role of new technologies in transfer pricing management is growing, supporting businesses in navigating the shifting regulatory landscape. A major challenge continues to be the harmonization of regulations and ensuring tax certainty amidst global transformations. Experts agree that the future of transfer pricing will involve striking a balance between simplifying the rules and maintaining the necessary precision to meet the demands of both tax authorities and multinational corporations.