For a considerable period, transactions between related entities have been a focal point of tax authorities worldwide. A fundamental element of these transactions involves to the precise determination of the market value of goods and services transferred within corporate groups. This, in turn, directly impacts the determination of tax liabilities. A particularly challenging area of this field pertains to the valuation of intangible assets, which, due to their intangible nature, are difficult to assess unequivocally. Which valuation methods are most commonly used? The challenges of determining the value of an intangible asset in transactions between related parties are also considered. The following article will provide a comprehensive examination of the most salient aspects of this issue.

Introduction

The valuation of intangible assets is a pivotal aspect of determining a company’s market value. This valuation is imperative for conducting transactions such as mergers and acquisitions, the sale of shares, the transformation of the company’s operational structure, the contribution of the company or its organised part as a contribution in kind to another entity, and the procurement of external financing. Moreover, a consistent and reliable valuation facilitates informed decision-making in business and the efficient implementation of key investment processes.

A salient characteristic of intangible assets is their potential for significantly disparate utility across diverse business entities, compounded by the arduous task of unambiguous identification. Furthermore, the valuation process itself is not standardised. This creates conditions of significant uncertainty and the possibility of erroneous assumptions, which may consequently affect the correctness of the estimates made and their quality. Consequently, many of the valuation methods employed in practice necessitate qualitative assessments informed by the knowledge and experience of the responsible individual, often requiring close collaboration with the client.

The nature of intangible assets in the context of related-party transactions

In the context of related-party transactions, the profitability of operations within a given jurisdiction is often determined by intangible assets. Entities belonging to the same group may transfer rights to a brand, technology, know-how or customer bases to each other. The determination of the price (or royalty) for the use of these intangibles is therefore pivotal in order to eliminate allegations of irregularities in transaction accounting by tax authorities

According to the approach presented in the economic literature [1], the primary distinction between the market value and book value of companies operating within global markets is the impact of intellectual capital. This discrepancy cannot be explained by models based on traditional value factors. The most significant components of intellectual capital include:

- brand,

- knowledge/know-how,

- intellectual rights,

- technology and related processes,

- human capital,

- customer and database bases,

- stakeholder relations,

- reputation.

Enterprise Value (EV) is thus derived from the sum of the market values of the:

- assets used and identified in the balance sheets less the value of their sources of financing (liabilities and provisions for them),

- intangible assets not identified in the balance sheets as book values, which most often include the previously distinguished components,

- the value of goodwill, i.e. positive goodwill understood as the excess the acquirer is willing to pay for the company over the net value of the assets acquired, after also excluding the value of identified intangible assets not previously recognised in the balance sheet.

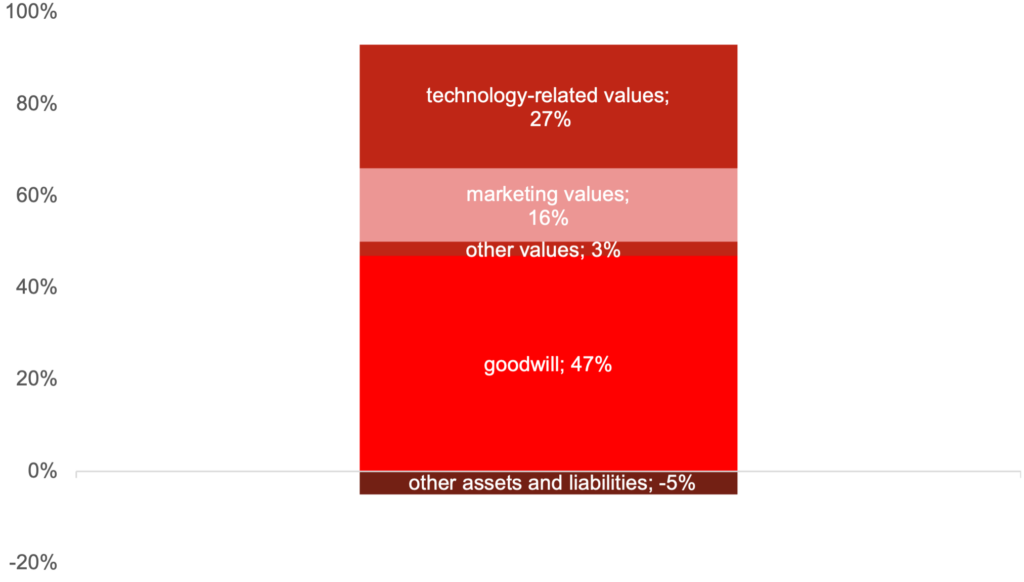

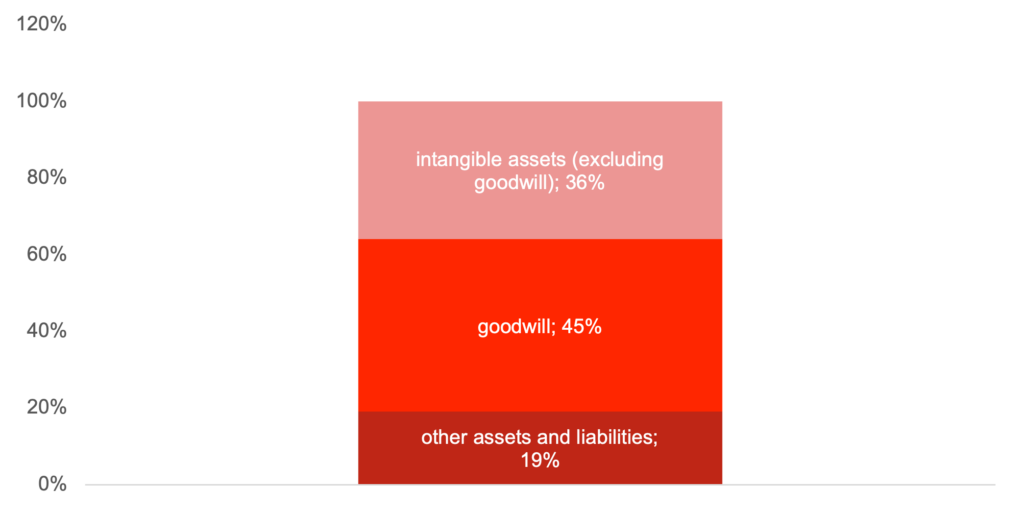

The contribution of positive goodwill (the excess of the purchase price over the value of the assets acquired) and intangible assets to the creation of corporate value is, in principle, significant. A review of the extant literature [2] indicates that, on average, this share for the market as a whole can reach 81%, and for some sectors, account for the entire value. Examples of such industries include the life sciences sector and the healthcare sector. In the case of the indicated industries, the indicated industries were responsible for the entire enterprise value of the companies, together with covering the identified gap between the excess of liabilities over assets. This is because these entities are characterised by generating losses in the initial phase of operations and financing their activities with debt capital, which results in the excess of the value of liabilities over the value of assets, i.e. a negative net asset value. The subsequent charts illustrate the examples describe

Chart 1. Structure of the components of enterprise value in the life sciences and healthcare industry

Source: Compiled on the basis of Intangibles in the World of Transfer Pricing. Identifying – Valuing – Implementing (B. Heidecke, M.C. Hubscher, R. Schmidtke, M. Schmitt, 2021)

Chart 2. Structure of the company’s value components in relation to the overall market

Source: Compiled on the basis of Intangibles in the World of Transfer Pricing. Identifying – Valuing – Implementing (B. Heidecke, M.C. Hubscher, R. Schmidtke, M. Schmitt, 2021)

Methodologies for determining market values of streams versus valuation of intangible assets

The valuation of intangible assets is a complex and demanding process as it involves assets that are often not directly reflected in book value. The distinctive characteristics of such assets, their absence of a tangible form, and the challenges inherent in estimating future economic benefits necessitate the employment of specialised valuation methodologies.

Relief from Royalties Method

One of the most commonly used valuation methods in the context of a transfer of an intangible asset is the Relief from Royalties Method. This method operates under the assumption that the value of an asset can be ascertained on the basis of hypothetical royalties that the holder is not obliged to pay because they have full ownership rights.

In practice, this method involves the determination of an industry-specific royalty rate and the subsequent estimation of the inflows that would accrue from royalties on the asset. The value of the resulting cash flows is then discounted at an assumed rate of return, determined using a variety of methodologies, including the DCF method. This process provides the fair market value of the intangible asset in question.

Individual method

Despite the popularity of the royalty exemption method, it is not always the most effective tool. In practice, the so-called individual (expert) method is frequently employed, as it has the capacity to yield more meaningful results in the following circumstances:

- innovative technologies or patents, which are unique and difficult to compare with other market solutions,

- customer bases or business relationships that are based on long-standing relationships with counterparties,

- copyrights, licenses, or know-how that have no immediate market equivalent,

- brands and trademarks, when their value depends on a specific image or recognition.

Individual methods are based on a combination of quantitative and qualitative analyses. This methodological approach enables the consideration of the uniqueness of the intangible asset, in conjunction with the particularities of the market or industry. The accurate determination of the asset’s value, in conjunction with its intended usage or creation context, facilitates a more precise identification of the associated risks and opportunities pertaining to the asset’s rights.

Challenges and risks in valuation in related-party transactions

In the area of determining market values in transactions between related parties, it is crucial to document and justify the assumptions made in a way that is acceptable to both the tax authorities and other stakeholders. The subsequent section delineates the principal domains of risk and challenge pertaining to the valuation of intangible assets in transactions between related parties.

- The absence of comparable transactions: For unique assets, it is difficult to find similar market transactions, which prevents the use of simple benchmarking methods. Furthermore, the extent of the obligations and rights of the associated enterprises with regard to the intangible asset is subject to reconstruction, particularly with respect to the identification of the entity(ies) that provided the financing, conducted the research and development, and executed the functions essential for the utilisation of the intangible asset [3].

- Uncertainty about future benefits: Intangible assets can generate profits over the long term, and the impact of market factors (e.g. competition or technological advancement) have the potential to substantially modify the value outlook.

- Different perspectives of the parties to the transaction: The entity selling the asset will seek to maximise the price, while the buyer will want to reduce the acquisition costs. In the context of related parties, adherence to the arm’s length principle remains a pivotal consideration [4].

- Regulatory and tax aspects: Tax authorities in different countries may take different approaches to assessing the valuation methodologies used. It is important that the transfer pricing documentation contains a sound and comprehensive justification of the methodology adopted.

The role of expert support

The valuation of intangible assets is a complex process that demands financial expertise and an understanding of the specific industry in which the asset operates. SWGK, operating as part of the international ETL advisory group, provides comprehensive support in this area.

It is evident from our experience that the following elements are of particular utility when preparing valuations of intangible assets:

- multi-industry know-how – understanding what key factors influence value in a particular industry,

- legal and tax competence – to assess the regulatory and legal risks associated with the transfer of intangible assets,

- practical approach – combining quantitative methods with an in-depth qualitative study of the assets being valued.

Conclusion

The valuation of intangible assets in transactions between related parties is of crucial importance in order to comply with the arm’s length principle and to protect against allegations of irregularities in tax settlements. Indeed, the value of intangible assets has been demonstrated to have a significant effect on the financial performance of individual companies, and consequently their tax liabilities and the perception of the entire group by investors and audit authorities.

The valuation of assets of this nature is a complex undertaking. It necessitates the utilisation of meticulously selected methodologies (e.g. Relief from Royalties, individual method) and a comprehensive analysis of numerous factors, including the uniqueness of the technology, the scale of the business, and the prospects for market development. The experience and knowledge of those carrying out the valuation is also crucial.

SWGK specialisies in this type of valuation, combining expert knowledge with a hands-on approach to provide clients with reliable analysis. The company is committed to maintaining the highest standards of professionalism at every stage of the collaborative process, and is well-equipped to address even the most challenging projects.

[1] Intangibles in the World of Transfer Pricing. Identifying – Valuing – Implementing (B. Heidecke, M.C. Hubscher, R. Schmidtke, M. Schmitt, 2021)

[2] Intangibles in the World of Transfer Pricing. Identifying – Valuing – Implementing (B. Heidecke, M.C. Hubscher, R. Schmidtke, M. Schmitt, 2021)

[3] Lipniewicz, R. Intangible assets in the calculation of transfer pricing – background considerations the BEPS project

[4] Menet, G. (2013). The transfer price as an economic tool influencing the results of the subsidiaries in the transnational capital group-possibilities and areas of use (Doctoral dissertation, Department of Finance and Accounting)